A willingness to accept equity as part of your agency or law firm’s fees can bring in more work that stimulates your team and exposes you to disruptive opportunities that are potentially very lucrative. However, there are a number of considerations to explore before agreeing to accepting equity as a portion of your firm’s payment. If you are considering a proposal from a wide-eyed entrepreneur who is looking to hire a design agency and is trying to preserve their cash here are six considerations to mull over before signing on for the job:

1. Who? Any service provider that is willing to bet the business they are working for is going to be worth considerably more in the future than it is today. Companies that take these creative fee structures are usually solo practitioners or companies with a limited number of partners who are amenable to accepting such compensation. Law firms or large accounting businesses with multiple partnerships often have difficulty parceling out the equity portion of these fees amongst its members. Investment banks on the other hand are keen to accept an “equity kicker” as an added incentive to make sure a deal “gets done”. Other service providers who accept equity as part of their service fee structure include web designers and developers, executive recruiters, business brokers and sometimes even caterers. Google’s famous 56th employee, Chef Charlie Ayers joined Google in 1999 was paid 40,000 in Google stock as part of his compensation package. Charlie eventually sold those shares for $26 million when he left the business in 2005, which meant he earned $4.3 million for each year he worked at the start-up.

2. Valuation. If you are looking to work with a start-up it has to have an established value agreed upon by all parties. This valuation can be difficult to set if there have been no or little funds raised from say a “friends and family” round. If the valuation is set too high, the equity the service provider earns would not fairly compensate them for the work they provide. There are many service providers such as software developers who will not work for equity unless an investment has been made by an institutional fund. One way to avoid the valuation dilemma for start-ups is to structure the equity portion of the fee as if it is a bridge loan that can be priced at a discount to a formal round that can be made at a future date.

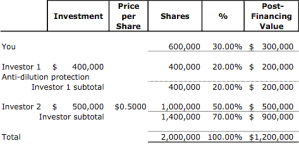

3. Dilution. The service provider must understand that the equity portion of their fee will be diluted as further rounds of capital are raised. As the company issues more shares for subsequent investors who back the start-up the portion of the service provider’s equity will diminish with each round of investment and further issuance of shares.

4. Liquidity. According to a report by Ernst & Young “Although VC-backed activity increased, (in 2010) the median time from initial VC financing to an IPO exit remains long. In the US, the median time to IPO exit in 1H 2010 reached 9.4 years, the longest span on record.” Given that an agency or development shop can begin work long before an institutional round is raised it can take a long time before a service provider will realize any liquidity on the equity portion of their fees. If the vendor has a cash flow issue themselves they might not want to take any equity at all given this time constraint.

5. Aligned incentives. Blended service fees are particularly good for service providers who expect to continue their relationship with a start-up for a long period of time. Since the equity portion of the fee can grow to be much more valuable than the cash paid out in the initial stages of the contract, the agency or lawyer is motivated to consider the long-term prospects of his or her client rather than focus on the immediate requirements of the project at hand.

6. Risk. Everyone likes a happy ending and the tech world is no different. We are all familiar with the stratospheric success of the likes of Mark Zuckerberg, Larry Page and Steve Jobs. The reality is that far more start-ups flame out or die a slow withering death while those entrepreneurs who “hit it out of the park” are few and far between. A quick glimpse at TechCrunch’s “Deadpool” is testament to the enormous risks any entrepreneurs must face. At Kluge, we approach equity compensation as if we are stock investors. We only take on as much equity exposure as we are prepared to lose.

Entrepreneurs take enormous risk and dedicate years of highly focused effort in order for their vision to become a reality. Offering to shoulder some of that burden while exposing your company to the potential benefits of the rewards will show your early stage clients the degree to which you believe in their vision. These projects can be tremendously rewarding in regards to the creativity and challenges they offer. However, such speculative work should only make up a fraction of a service provider’s overall revenue base in order to minimize the impact should an entrepreneur’s vision fail to gain traction.

Cameron: You have set out a very good overview of a complex decision process, or at least one that should be complex.