Here is a phenomenon I discovered over time when dealing with many small start-ups in  their early revenue period. A very predictable series of rotating crises seemed to befall most every one of these young companies. These became so predictable that I could accurately label them as occurring about every $3 million in gross profit (or revenue for service companies). By defining this in terms of gross profit, we can include distributors with 15% gross margins as easily as software companies boasting nearly 100% gross margin.

their early revenue period. A very predictable series of rotating crises seemed to befall most every one of these young companies. These became so predictable that I could accurately label them as occurring about every $3 million in gross profit (or revenue for service companies). By defining this in terms of gross profit, we can include distributors with 15% gross margins as easily as software companies boasting nearly 100% gross margin.

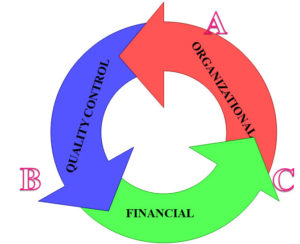

Explaining the rotating series of crises

There is a rotating series of predictable crises that most often reveal themselves like this:

The first crisis: organizational

At approximately the $3 million gross margin mark, the company often has grown from founders to about 20 employees, or an estimated $150 thousand in the same measure, per employee.

Of course, venture-funded startups with long product creation times do not fit this mold as easily, often funded for long periods of losses with many more employees at hand in development positions.

[Email readers, continue here…] But at or around the 20-employee mark, the founders usually find that two things occur. The original management span of control is exceeded, and management must be delegated to one or more middle managers to maintain efficiency in the workplace. Second, some of the original employees, occasionally one or two friends of the founders, are discovered to be falling behind as more professional employees show them up to be less competitive in their jobs. So, management reorganizes the structure of the organization to fit the new needs of the growing enterprise. The risk is real: that the first person hired to step in as middle manager below the entrepreneur doesn’t last for a year, often as a result of the entrepreneur’s inability to let go of those processes and let the new manager perform, no matter how talented or experienced the new manager.

The second crisis: quality

At about the $6 million mark, in my experience, revenues have ramped to the extent where the original product standards of quality are challenged, as is the speed and efficiency of customer service. Changes need to be made quickly to preserve the reputation of the company, adding a quality control function if not present, adding more QC steps in the process, addressing the number of customer service people on the line, creating longer hours to serve a larger customer base.

At about the $6 million mark, in my experience, revenues have ramped to the extent where the original product standards of quality are challenged, as is the speed and efficiency of customer service. Changes need to be made quickly to preserve the reputation of the company, adding a quality control function if not present, adding more QC steps in the process, addressing the number of customer service people on the line, creating longer hours to serve a larger customer base.

Failure to respond to this predictable crisis quickly labels a company as a provider of poor quality, which seems to travel unbelievably fast among your industry’s gossip machine, helped by competitors anxious to point out your problems. And once you’ve fixed this, the perception of a fixed problem lags the reality by many months, making this a particularly tough crisis, common as it is.

The third crisis: working capital

At around the $9 million mark, the company suffers a most predictable cash crisis, one where the costs of growth in working capital and infrastructure creates the need for new sources of funds from investors, banks or asset-based lenders. If the company is not profitable, these channels for capital are not as easily tapped, extending the crisis and challenging the health of the enterprise.

And the surprise…

At around the $12 million mark, the company finds itself having traveled full circle, and in need of reorganization again along with a bit of house cleaning, pruning the poorer performers from the ranks. That seems to happen around the 80 employee count, a time a little beyond when the company should have transitioned to a professional human resources manager to help solve this and future employee crises.

Do these crises strike you as familiar?

They should, even if the dollar amounts are out of alignment with your experience, since some companies are funded well enough to skip the first financial crisis and some so efficient as to skip the first organizational crisis.

Well, with this insight, you should be equipped to spot early signs of each crisis and plan around them in time to avoid the full impact of each in turn. Let’s hope you and your management team recognize and react – now that you know the “every three-million-dollar crisis” and its signs to watch.

Timely, since I am planning on having to face these challenges in the next few years with my new venture.