500 Startups Presents Bitcoinference

Coming hot off the tail-end of a much involved SXSW week (where the talk of the town was wearables, alternate-communication apps, and the internet of things); I was excited to immediately find myself in the heart of Silicon Valley, discussing a personal subject of my own curiosity: Bitcoin.

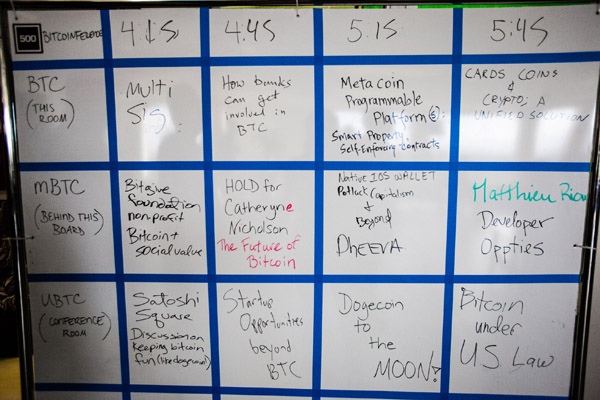

Introducing Bitcoinference | A Decentralized Conference, hosted by illustrious startup accelerator, 500 Startups. To be more specific, as 500 Startups’ Bitcoin head, Sean Percival described, the event was an unconference; meaning, the open-board signup sessions were as much a part of the day’s activities as the official speaker panels. The sessions served as a space where enthusiasts, innovators, and investors, of all scales could come together for open conversations about the crypto-currency space.

Bitcoin has had a rough start to the year (to say the least) – with a never-ending news feed consisting of massive bankruptcy, scandal stories, and car chase media fiascos. In light of a less than savory PR landscape, I saw this event to be an important call to attention to the developements towards the Bitcoin industry for 2014, as well as geographically important gathering of minds and enthusiasts in the space.

The Bitcoinference served as day 1 of 2 for 500 Startups’ “Commercism” series, with an official agenda that covered industry happenings, social dynamics, and a look into the investment environment.

Getting Things Started

As a reminder to some new developements in the space, 500 Startups recently announced their plans to include a Bitcoin dedicated arm to their investment/accelerator portfolio with venture partner, Sean Percival at its helm. Sean kicked off the festivities by going over house rules to maintain an open, supportive environment.

He then dove into a keynote Q&A with Dan Held, developer of recently acquired Zeroblock LLC.

Zeroblock, the highly successful mobile and web app was recently acquired by the world’s most popular Bitcoin site and online wallet, Blockchain.info. The transaction is considered the largest public acquisition in Bitcoin history with both companies exhibiting impressive growth numbers since their respective beginnings.

Dan, now named as Product Manager for the Blockchain acquired Zeroblock apps, tells the audience about life after acquisition.

Interestingly, the deal was done online and in a matter of minutes, and he provides some cheekily comedic commentary on his tax CPA father’s initial horror in the speedy nature of the transaction. He does though, note the support that he’s received from his family and the Bitcoin community.

The conversation moves into Zeroblock’s upcoming plans to implement trading API’s, a robust front-end interface for trading, as well as goals to create a standardized protocol in connecting different exchanges (thereby leveling out bitcoin prices across the board). The ultimate plan? Be the Bloomberg of Bitcoin.

To comment on the rocky state of Bitcoin affairs in the last 30 days, does Dan believe we’re past the worst of a media firestorm? Perhaps, he says, but it is always difficult to speculate. Overall, he remains optimistic towards Bitcoin prices and cues the Dogecoin community’s phrase “to the moon!”

Women in Bitcoin and Public Perceptions

The next part of the day consisted of a panel moderated by TechZulu’s very own Amanda Coolong. The subject on hand? A profile of the state of the Bitcoin industry and its presence of female entrepreneurs. Speakers here consisted of:

- Arianna Simpson – Crypto currency blogger

- Connie Gallippi – Of Bitgive, a Bitcoin charitable giving organization

- Pinguino Kolb – Owner of Spelunk.in, an online crypto currency magazine

Bitcoin’s PR War

Our panel notes that Bitcoin’s problems are as much to do with public perception as they are to do with education. Collectively, any feelings of exclusion have come as a natural reaction from working within the broader tech landscape in general, not specifically Bitcoin.

In fact, their experiences with the Bitcoin communities have overall, been positive. The supportive, fun, and charitable nature of the Dogecoin community comes up multiple times within this conversation, alongside the fast growing rates of participation of women in this community.

A clear distinction our female entrepreneurs have made here has been their active decisions to hit the ground running. They encourage all enthusiasts and entrepreneurs, regardless of gender, or side of the discussion to do the same: to do personal research, read the white papers, and learn for themselves what peer to peer digital currencies have to offer.

And of course, to extend a supportive and educated hand to inquisitive friends and acquaintances – through social media, fact checking, and a call to disconnect from toxic news stories.

What is it Like to Raise Money for Bitcoin Companies?

The next portion of the discussion moves into investments into Bitcoin: the currency, technology, and in startups in the space.

Moderated by 500 Startups founder Dave McClure (who openly admits to knowing nothing about Bitcoin), our panel consisted of a mix of venture capitalists, angel, and accelerator investors:

- Joyce Kim – VC at Freestyle Capital

- Brock Pierce – Digital Currency Entrepreneur and Angel Investor

- Adam Draper – Of Boost VC, an SF Incubator/Accelerator

Dave McClure’s signature straight-forward and no-BS approach sets the tone and brings the discussion back to the ground – out of an idealistic height of optimisim, into a context of what life is like for our investors, to bet their reputations and financial livelihoods on a volatile, emerging technology.

Not that enthusiasm and passion aren’t encouraged of course, but it is important to be real.

Our panelists go down the line with their financial involvement with the currency itself, and a quick snapshot of what their portfolios look like. Overall, they show bullish investment, but remain strategically cautious.

- Adam states that Bitcoin is now a large portion of his personal net wealth and has to date, backed 11 companies through Boost. They aim to push 100 companies through their doors in the next three years with ~$50k seed investments.

- Brock has personally invested close to $1M into the currency itself, and a bit shy of $1M into the companies/ecosystem with 12 funded Bitcoin companies in 2014 alone.

- Joyce notes one Bitcoin company that Freestyle VC has invested in, and hints there are more on the way. She explains Freestyle VC’s specific “no competition” investment policy with active decisions to bypass investments that compete with companies in their portfolio.

Dave asks: “What’s bolshevik in Bitcoin?”(Actual words: Bull Shit)

The panel discuss the fast emerging alt coin industry (cryptocurrencies that differ from the original Bitcoin protocol), and note that in one years time, we’ll see hundreds more specialty coins in the market place, if not thousands.

By nature of things, there will be much bolshevik as a result of amateur programming, pump and dump schemes, and coins that fail to build proper communities behind them. Adam believes there will only be a handful of pertinent players in this space. Bitcoin, litecoin, maybe doge.

Joyce points out the extreme lack of quality user experiences and reminds us that her firm emphasizes investing in great entrepreneurs – something the industry has unfortunately struggled with as a whole as the concept has moved from the deepest reaches of Reddit discussions and living rooms, into proper corporate settings.

Despite all this, they collectively believe in the burgeoning peer to peer, de-centralized trust technologies and remain firm on their stance to continue funding promising startups in the space. Some rapid fire discussion points.

- Brock’s project in December 2013 that we would see half a billion dollars in investments for 2014. So far, there’s already been $90M of investment money.

- Joyce predicts a lot of money coming from a few investors.

- Our panel maintains they are not in the business to fund forex traders. Companies must be reliant on their functions outside of holding Bitcoins for value.

- Despite bad press (Silk Road, Mt Gox, etc.) and inconsistent international regulations, the growth of adoption for Bitcoin has been indisputable.

- A hilarious but compelling conversation about Bitcoin’s role in the “vice” industries: marijuana, gambling, alcohol, etc.

The Unconference

We took this opportunity to sit in a session that covered increased security in Bitcoin transactions with Ryan Singer and his company Crypto Corp – who are developing game changing multi-signature technology to lower the friction of Bitcoin transactions as they relate to security and fraud detection.

To round off the day, we took part in a conference room fireside to discover startups working on the Bitcoin protocol, both in and outside the currency. A snapshot of some of the projects mentioned:

- International remittance services

- Escrow applications

- Payment apps that integrate with wearbles

- E-Commerce ventures utilizing Bitcoin

- Bitcoin specific job boards

- Mining hardware and multi-protocol mining chips

- Trading platforms

- Platforms for contributing Bitcoin to political and charitable causes

Setting Up 2014

The discussions at Bitcoinference pointed to a promising year of important moves, along with some very real prospects of more failures and growing pains. Overall, everyone seems to agree there will be a continued shakedown of amateurs out of the space.

But as a second wave of entrepreneurs and new technologies enters the fray, the Bitcoin economy will stabilize through the year. Thank you to the great people at 500 Startups for hosting a great event! Be sure to visit them for more info.