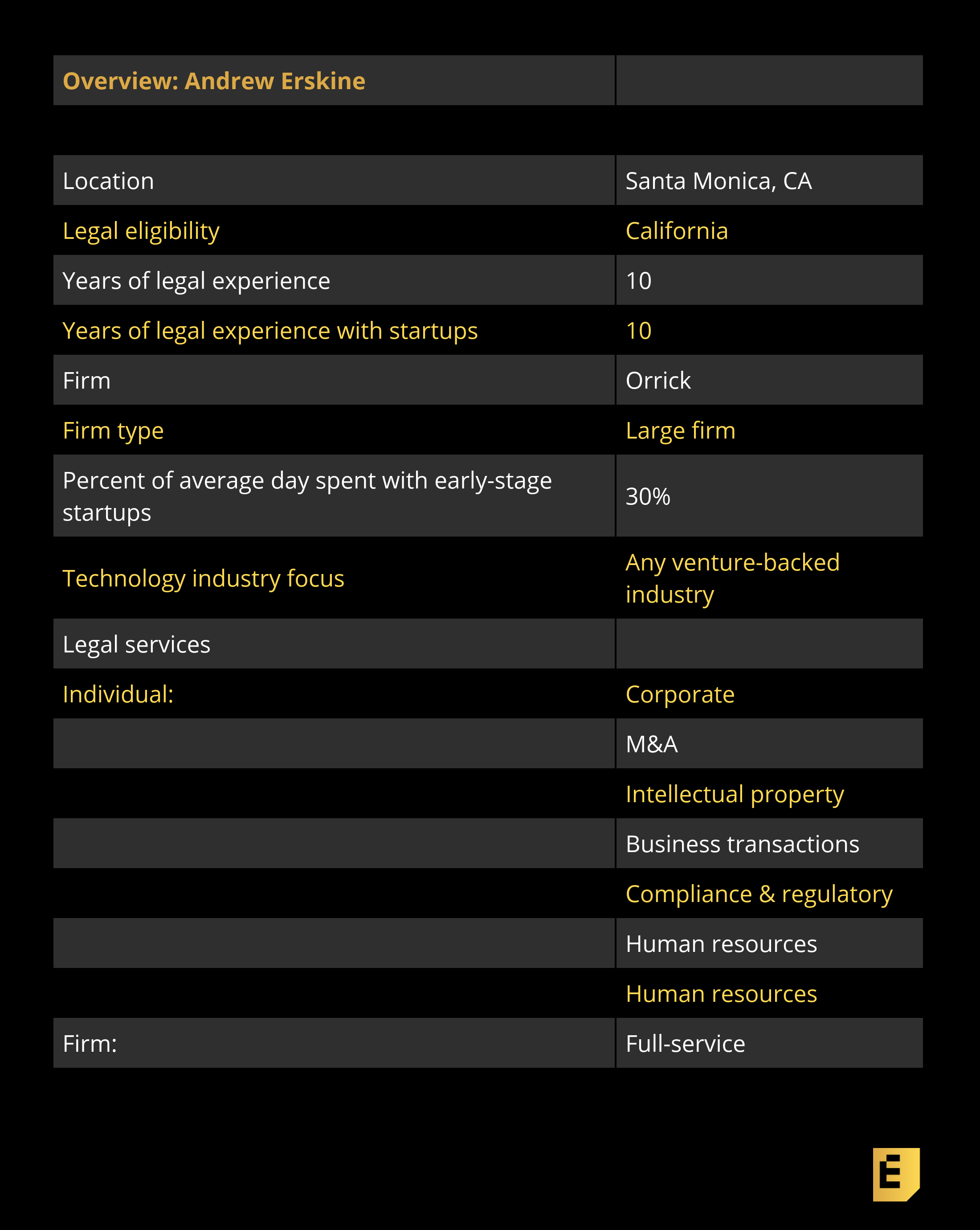

Andrew Erskine has developed his legal career along with the rise of the tech startup scene in Los Angeles. Today, as a partner at Orrick in its Santa Monica office, he works with companies large and small in the area and beyond.

His approach:

“The way that I practice and the philosophy I have is that clients aren’t really coming to me with legal problems. They’re coming with business problems and we need to solve them with that context. It’s almost never an answer of, ‘This is the law, now go do what it is that the law says exactly what you need to do.’ It’s more of, ‘This is the way that your business works and how I understand it, and these are the rules that are set out for you to follow and you need to think about how to follow them.’”

On LA’s startup scene:

“Andrew provides the same level of effort, expertise and professionalism when I was a pre-seed company with no capital as he did when we had raised $100 million.” Brian Thomas, Los Angeles, co-founder, Clutter

“I spend a lot of time just trying to put people in touch with each other, including a lot of people that are not my clients — I don’t do any work for them. They’re just people that I know in the community and we’ve become friends and I’m trying to make sure that what they’re trying to do is growing at the same rate.”

On early-stage problems:

“We’ve had acquisitions in the ten figures in recent years where people were coming out of the woodwork at the very last minute saying, ‘Hey, I own a piece of this company.’ And it was just something that founders never really thought to raise and then of course you’re dealing with the huge issue at the most critical point in the company’s history. So, things like that will happen.

“A lot of that is just trying to get that out of founders that you start working with, the stuff that you see in your experience can come back to really bite people, you just ask them day one, right away. ‘Hey, are there skeletons in the closet? Because if there are…’ ”

Below, you’ll find the rest of the founder reviews, the full interview and more details like their pricing and fee structures.

This article is part of our ongoing series covering the early-stage startup lawyers who founders love to work with, based on this survey (which we’re keeping open for more recommendations) and our own research. If you’re a founder trying to navigate the early-stage legal landmines, be sure to check out our growing set of in-depth articles, like this checklist of what you need to get done on the corporate side in your first years as a company.

The Interview

Eric Eldon: How did you get involved with tech companies and startups?

Eric Eldon: How did you get involved with tech companies and startups?

Andrew Erskine: I was a summer associate over here in LA and a bunch of outside groups would come talk about what they do. There was like one guy in the city working with startups and he came in and explained what he did and that was it. I heard him and I was like, ‘That’s what I want to do. Period.’ Just the way that he described what he was doing, the level of contact that he had with the people that are making decisions at these companies, the actual founders and lead investors, and the ability to not just be providing purely legal advice, but really trying to help these companies grow and build a vessel around them, giving them business advice, personal advice, whatever it is. It just sounded so much more fascinating than the idea of being one out of 100 on a deal and I just decided that I had to do it and it turned out really exactly how I hoped it would.

Eric Eldon: Can you just tell me more about how you see a lawyer playing a role in developing a tech startup ecosystem?

Erskine: The way that I practice and the philosophy I have is that clients aren’t really coming to me with legal problems. They’re coming with business problems and we need to solve them with that context. It’s almost never an answer of, ‘This is the law, now go do what it is that the law says exactly what you need to do.’ It’s more of, ‘This is the way that your business works and how I understand it, and these are the rules that are set out for you to follow and you need to think about how to follow them.’

The LA community has gotten to a point where it’s sophisticated and it’s significant. It’s one of the largest communities in the world, but we still need to be doing what we can to protect it and support it and help it grow further. It’s because we touch so many early-stage companies and, obviously, we have a lot of communication with early-stage investors and as you go up the chain, mid-late stage as well, a lot of it is also just trying to make sure that people are being connected the way that they need to be. I spend a lot of time just trying to put people in touch with each other, including a lot of people that are not my clients, I don’t do any work for them. They’re just people that I know in the community and we’ve become friends and I’m trying to make sure that what they’re trying to do is growing at the same rate.

Eric Eldon: Are there any specific instances you can share about founder disaster stories? Those are often the most instructive.

Erskine: There’s a lot of times when I think early-stage founders, first-time founders in particular, are just thinking about whatever it is that they need to do to get to the next step. And not necessarily realizing that, yes, you do need to get to the next step, but you can probably also do that in a more strategic way. Just trying to help them understand what that’s going to look like six months from now, 12 months from now, two years from now. I often will see a lot of people rush forward and think about the consequences of those things later. Then all of a sudden they’re sitting in a mid-stage financing and they barely own enough of their company. That’s a pretty common mistake.

We’ve had acquisitions in the ten figures in recent years where people were coming out of the woodwork at the very last minute saying, ‘Hey, I own a piece of this company.’ And it was just something that founders never really thought to raise and then of course you’re dealing with the huge issue at the most critical point in the company’s history. So, things like that will happen.

We’ve had acquisitions in the ten figures in recent years where people were coming out of the woodwork at the very last minute saying, ‘Hey, I own a piece of this company.’ And it was just something that founders never really thought to raise and then of course you’re dealing with the huge issue at the most critical point in the company’s history. So, things like that will happen.

A lot of that is just trying to get that out of founders that you start working with, the stuff that you see in your experience can come back to really bite people, you just ask them day one, right away. ‘Hey, are there skeletons in the closet? Because if there are…’

The last thing is entrepreneurs can be such a tour-de-force and particularly for first-time founders, getting used to when you’ve gone through some rounds of funding, and you’ve put people on your board… you may not have really appreciated what that working relationship was going to be like. I think a lot of times, first-time founders don’t completely appreciate that if somebody’s saying, ‘I’ll give you this money, but I want to sit on your board,’ exactly what that means and just what that relationship is going to be like going forward, and what you’re going to need to get out of them, and how that’s going to work.

Because entrepreneurs can be so focused, it can be easier for first-time founders to not quite have that combination of tenacity, but also malleability and adaptability and receptiveness to others’ input and that can become a real conflict. It can, in some cases, really halt big-picture strategy for companies because the founders are trying to deal with getting on the same page as their board members and it can set things sideways.

Eric Eldon: What’s your fee structure?

Erskine: So, the rate structure starts off in many ways like a typical, traditional rate structure that you expect. As a big firm, we’re charging high rates for high-quality counsel and it’s by the hour, but obviously there are nuances. So, in certain cases we offer deferrals. Then there are personal things that I do that I think are aimed at making sure that, overall, fees are low. For a lot of early-stage companies, you just end up giving away a lot of your time, but also setting up routine calls to go through everything that’s going on with the company that also isn’t costing them any time.

Mostly that isn’t even about the hour that you spend on the phone with them, it’s about finding out what’s going on with the company so that three weeks later, if they need something, you knew it was coming and you can do it relatively inexpensively rather than ‘this has to be done in two hours,’ so all of a sudden you’ve got someone really expensive with a lot of experience on it charging more than they’d probably want to pay just so you can get it done at the pace that a startup needs to move.

So, you try and do things like that… we will try to get creative on certain things like if there are larger transactions where we know that the company’s going to have only so much available cash to be able to pay its fees. We’ll try and strategically think through 1) what’s the structure of the deal going to look like and then 2), offering fixed fees on some of those things.

Sometimes it makes sense, sometimes it doesn’t. Then the other thing that I think is actually nice about our firm is that we spend a lot of time developing internal technology and internal groups that leverage some of the technology including — this is going to sound silly, but it is true — using artificial intelligence resources that we have to make sure that a lot of the work that on larger transactions used to cost a fair amount of money, we can do that for an extremely low price. So, some of it’s just innovating with the technology that we’re building within the firm.

Founder Recommendations

“Andrew is hands down the best lawyer I have ever worked with on my company. He has helped me avoid major legal issues, gone above and beyond to build founder friendly terms into deal terms we were doing with VCs, been willing to talk at all hours of the day, and been super flexible with us when times were tough and we had a large outstanding bill. He never lets us down, and I’ve referred multiple other founders his way.” – Brian Freeman, Venice, CA, CEO at Heartbeat

“Andrew is really smart and doesn’t just offer advice. He’s first like a good shrink that tries to understand what you are trying to accomplish then helps you figure out the right way to go about it in the most cost/time-efficient way. He’s there for you in any weather condition.” — A founder and investor in Los Angeles

“Andrew always provides a thorough response and promptly replies to all questions. In comparison, I’ve experienced much briefer and less detailed responses from other lawyers. This can make a huge difference for strategic planning and quick decision making before deciding to dig deeper into potential issues.” — Ashod Donikian, San Francisco, founder and CEO of Navisens

“Andrew provides the same level of effort, expertise and professionalism when I was a pre-seed company with no capital as he did when we had raised $100 million. His greatest contributions were anticipating problems so they didn’t actually materialize. He knows his strengths and when an area is outside of his expertise he has a colleague advise without billing for their time.” — Brian Thomas, Los Angeles, co-founder, Clutter

“Fantastic, fact-based, level-headed, and business-minded advice with an ability to move quickly on issues and resolve them.” — A VC in New York City

“Supported us through the closing of $200M+ in financings, the signing of 5+ major partnership deals, and providing expert guidance on various corporate structuring initiatives.” — Dan Bell, Los Angeles, Chief of Staff, Inspire

“Andrew advised the founder on all corporate matters related to the formation of the company. He was invaluable in our Series B round of financing.” — A GC at a mid-stage startup

“Instant, thoughtful responses at all times. I didn’t even have to worry for a second about legal issues — I just knew they’d be handled perfectly.” — Andy Bromberg, San Francisco, co-founder and president at CoinList (co-founder and CEO of Sidewire when working with Andrew)