Two years after the Los Angeles-based fintech startup Dave launched with a suite of money management tools to save consumers from overdraft fees, the company is now worth $1 billion thanks to a nascent banking practice that had investors lining up.

The company used its overdraft protection service and money management display to shift customers’ focus away from the total balance that their account would show by giving them a sense of how much was actually left in their accounts once debits were included in their statements.

“What was cool about our financial management product was that we were trying to use Dave as a replacement for their current bank,” says Jason Wilk, Dave’s co-founder and chief executive.

Dave now counts over 4 million users for its financial management app and has roughly 800,000 people on the waiting list to use its banking services, Wilk says.

The company has taken a methodical approach to opening its doors as a digital bank, in part because it wants to have the necessary support infrastructure in place to service the demand that Wilk expects to see for its service.

“It’s one thing to help people with budgeting. It’s another to actually manage their money,” says Wilk.

Dave will use the $50 million raised from Norwest to significantly expand its product and engineering team within the next 12 months, in order to double down on the core business and ensure the success of the banking product.

“We can prove that Dave can be helpful by showing how we can help you manage your current account, and then Dave banking is the marketing lever from there,” says Wilk.

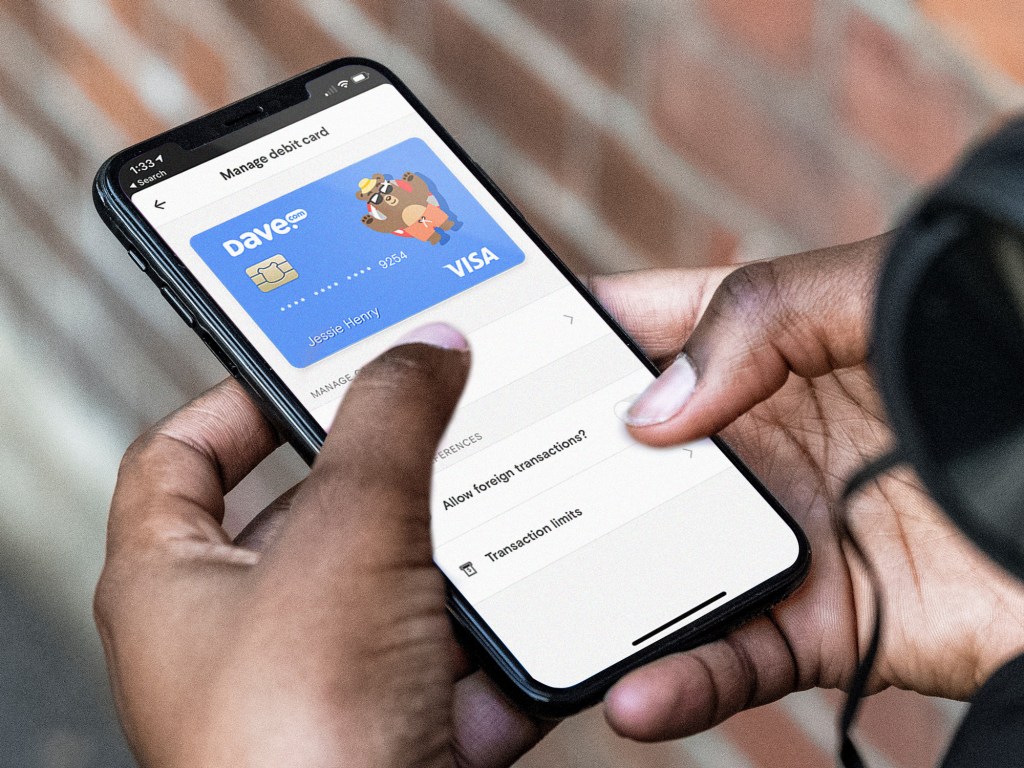

For now, customers need to have the financial management app installed to be able to access the company’s banking service.

Dave charges $1 per month for access to its financial management tools and that also gives customers the ability to use a cushion of between $50 to $75 to avoid being hit with overdraft fees from their current bank account. Dave asks for a tip every time a customer uses that cushion to cover expenses — something that Wilk says is still cheaper than having to worry about overdraft fees.

And, to add a bit of environmental spin, for every tip that Dave receives, the company plants a tree. “We plant millions and millions of trees,” says Wilk.

The company is FDIC insured through a partner bank, the Memphis-based Evolve Bank and Trust, which acts as a backstop for the company’s financial management activities.

“We already had a relationship with them for some payment processing stuff,” says Wilk. “We liked the team and liked the terms and went with them.”

Terms between financial services firms can vary, and, Wilk says, Evolve Bank was willing to give the company a good deal on splitting the interchange fee, which is a big source of revenue for upstart banks.

It’s possible that Dave could have received a bigger check at a potentially higher valuation, but Wilk says the startup is trying to stay lean.

“The company is growing so quickly, we didn’t want to get too diluted on this round,” he says. “We think the company is quite a bit more valuable than [$1 billion]. You don’t want to raise too much money too quickly if you really think the valuation is going to climb… Since we signed the term sheet the company has already grown another 40%.”

It was only four months ago that Dave was announcing a $110 million credit financing with Victory Park Capital and the launch of its banking product.

Dave’s products and services have a few advantages for customers that are just getting started on the path to financial security. The company monitors everyday monthly payments and reports them to credit agencies to improve customers’ credit ratings. The company also provides up to $100, interest-free, overdraft protection.

“Banks have failed their customers by building products that put their own interests ahead of the humans who use them. People don’t need predatory fees, they need tools that actually solve their challenges around credit building, finding work and getting access to their own money to cover immediate expenses. Dave is the banking product that works with its customers, not against them,” said Wilk, in a June statement announcing the funding and banking product launch.

While Dave is getting some hefty firepower and a generous valuation from Norwest, it’s also operating in a market where its core services that were a point of differentiation are quickly becoming table stakes.

Earlier in September, the new startup banking company Chime announced that it had hit 5 million banking customers and was offering its own overdraft protection service.

Chime now has 5 million customers and introduces overdraft alternative

The San Francisco-based bank has also raised a lot more capital for a potential piggy bank to raid if it needs to acquire or spend on engineering talent to build out new products and services. Earlier this year, the company announced a $200 million round and said it had hit roughly 3 million customers. Clearly Chime is adding new banking customers at a torrid pace.

And they’re facing global competition as well. N26, the European startup bank with a $3.6 billion valuation and hundreds of millions in financing launched in the U.S. a few months ago as well.

The company sees a global opportunity to create new digital banking services in a world where large amounts of capital and an elite set of consumers move easily between international markets.

“We have an opportunity that we build a bank that has more than 50 million users around the globe. Today, we only have 3.5 million users but we’re accelerating,” said N26 chief executive, Valentin Self, in an interview with TechCrunch. “From a country perspective, we have agreed already that we go to Brazil. There’s no plan after Brazil yet. Now let’s focus on the U.S., then on Brazil, then next year we’ll find out what’s the feedback from these two markets.”

Comment