Need money? Read this!

Berkonomics

AUGUST 3, 2023

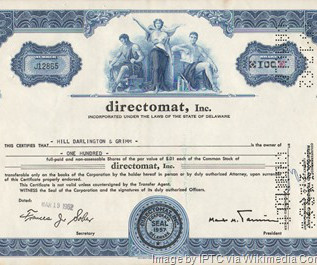

Some businesses require very little capital and the founder can self-finance the enterprise and retain 100% of its ownership and control from ignition through liquidity event (startup through sale). And even with the significant cost of credit card debt, many entrepreneurs aggressively use existing cards to finance a startup.

Let's personalize your content