In a recent update on LinkedIn Jason Calacanis recommended raising money on the promise of an idea, before a company launches its product. He reasons that prior to launch an investor cannot discount your valuation based on sluggish historical performance. The valuation will be based on how well you can sell your idea. I recently caught up with a classmate from UCLA Anderson and told him the exact opposite in regards to raising money for his own startup. In his case he was better off meeting with investors once he was generating revenues and could validate his businesses value proposition.

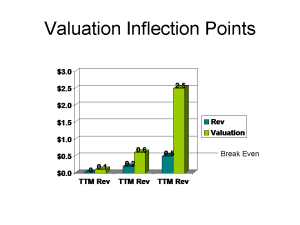

There are three basic valuation inflection points for any early stage company and each one typically increases the price investors are willing to pay in order to back the business.

Those inflection points are:

– Pre-revenue

– Revenue generating

– Cash flow break even

Since investors are looking to minimize the risk they are taking the more you prove your model works, the higher the price an investor will pay for equity in that business. This is particularly true if you have never raised investment capital before and do not have a record of exists like Calacanis.

Calacanis can champion his new company, Inside.com to potential investors because he is widely known throughout the VC community and already has a string of A players who have baked his other startups such as Mahalo. Because of his persona and reputation a bigger perceived risk for an investor is not having a chance to invest in the business at all. The assumption here is that Calacanis knows what he is doing and a pre-launch valuation will only increase from this point forward. This is exactly the perception Calacanis wants to create but there are very few entrepreneurs who have that kind of credibility.

As for my Anderson classmate, that will certainly not be the case. While he has great industry experience, because he has not personally raised capital he is much better generating some degree of revenue, even if it is small amount, simply to move his business from the pre-revenue, to revenue generating and thus lower the perceived risk

All the other advise Calacanis offers in his update is relevant for an entrepreneur, no matter how seasoned. There are no hard and fast rules for what a company is worth prior to being cash flow breakeven. Basically a business is worth whatever you can convince an investor to pay for it. This requires the founder to quell the fears of risk while talking up the opportunity. Since there are hundreds of vehicles where an institution or individual can invest their money, and seasoned investors are typically cynical by nature, it is highly unlikely a first time founder will raise any capital merely on the promise of an idea. In that case you are better off showing them the color of your money especially if the barriers to revenue generation are minimal.

Calacanis finishes his update with invitation for Lead and Front End developers in LA for his new business. I’d welcome a conversation if he likes what he sees at Kluge.

As for my friend Roger, I’m sure we will be hearing more about his business in the months to come.