What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

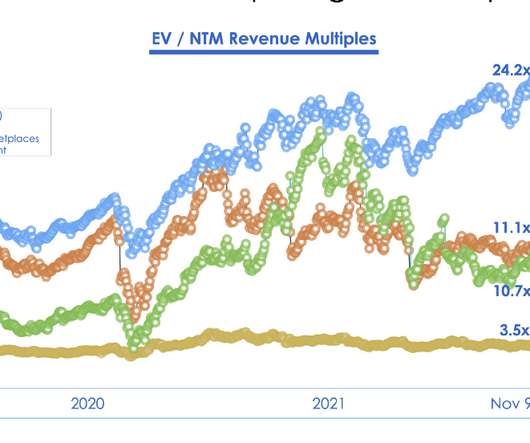

<== Our conclusion was that this isn’t a temporary blip that will swiftly trend-back up in a V-shaped recovery of valuations but rather represented a new normal on how the market will price these companies somewhat permanently. Across more than 10 years we have kept the size of our Seed investments between $2–3.5

Let's personalize your content