What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

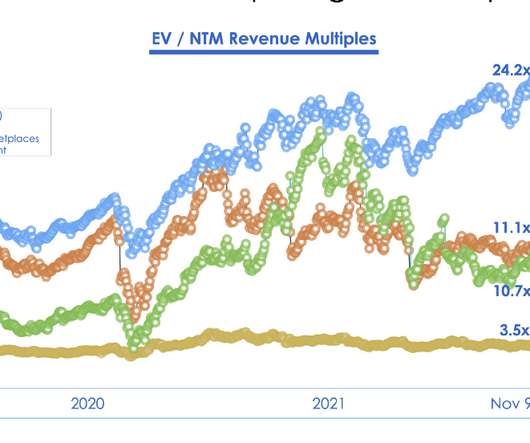

Even then private market investors can paper over valuation changes by investing at the same price but with more structure so it’s hard to understand the “headline valuation.” First in late-stage tech companies and then it will filter back to Growth and then A and ultimately Seed Rounds. By 2021 we had to write a $3.5m

Let's personalize your content