What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

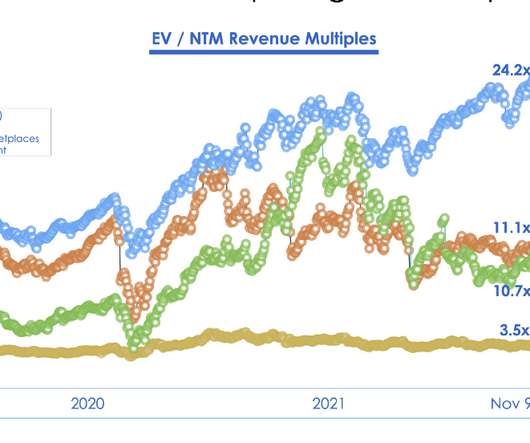

At our mid-year offsite our partnership at Upfront Ventures was discussing what the future of venture capital and the startup ecosystem looked like. Even then private market investors can paper over valuation changes by investing at the same price but with more structure so it’s hard to understand the “headline valuation.”

Let's personalize your content