Maestro nets $15 million for its interactive commerce, community and engagement tools for livestreams

TechCrunch LA

MARCH 2, 2021

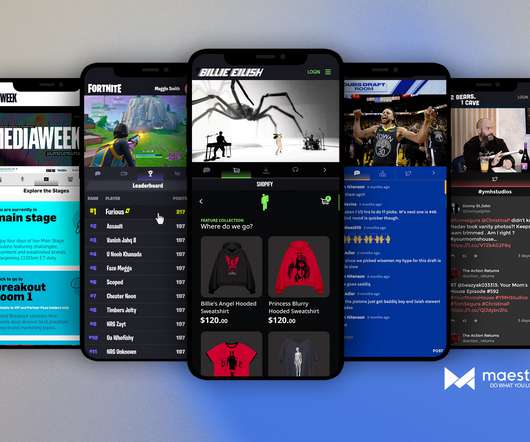

The company has already worked with names as diverse as the Golden State Warriors, the Dallas Cowboys, and pop sensation Billy Eilish on embedding its interactive tools into various live events and promotions. But what started in the gaming world quickly spun out as the company slashed prices to $500 per month for its services.

Let's personalize your content