Need money? Read this!

Berkonomics

AUGUST 3, 2023

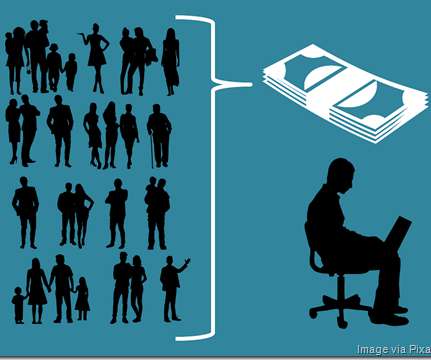

However, most often, these funds are solicited by a well-meaning entrepreneur from investors who are not qualified as accredited investors under the law (currently requiring a proved income of $200,000 a year or $1 million in net worth for an individual investor). Often private equity investors will want control of the business as well.

Let's personalize your content