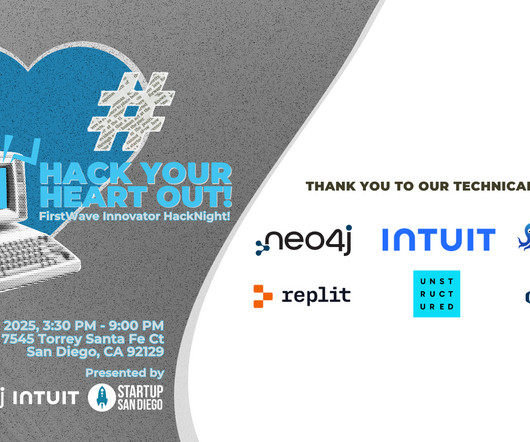

StartupSD FirstWave Innovator HackNight presented by Neo4j Recap

Startup San Diego

FEBRUARY 22, 2025

On February 19th, 2025 our developer and startup community came together for the first edition of the FirstWave Innovator HackNight, presented by Neo4j. This event welcomed over 250+ attendees at […] The post StartupSD FirstWave Innovator HackNight presented by Neo4j Recap appeared first on Startup San Diego.

Let's personalize your content