London and SF have become Impact Tech hubs, with 280% increase in VC in 5 years

TechCrunch LA

NOVEMBER 11, 2020

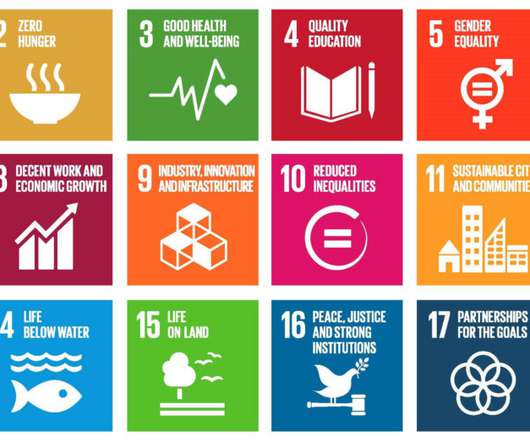

New research has found that San Francisco and London have become two of the world’s leading hubs for VC investment into tech solutions that address one or more of the 17 UN’s Sustainable Development Goals (SDG), more commonly referred to as “Impact Tech” They are followed by Paris, Berlin, Stockholm, Shanghai and Beijing.

Let's personalize your content