7 Secrets To Bank Equity Funding Without Collateral

Startup Professionals Musings

APRIL 22, 2023

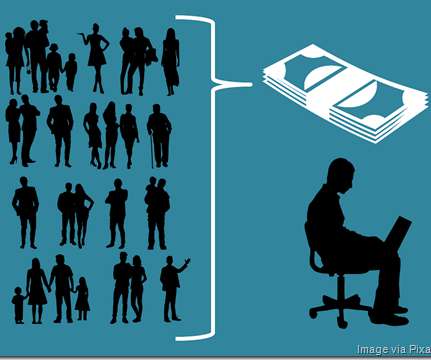

The first thing to remember is that banks only do loans – they generally don’t do equity investments like angels and venture capitalists (and vice versa). You have to get past how great the product is to address clearly what your business rationale is, why it is different from the competition's, and why it will succeed.

Let's personalize your content