Funding in the Time of Coronavirus

Both Sides of the Table

MARCH 5, 2020

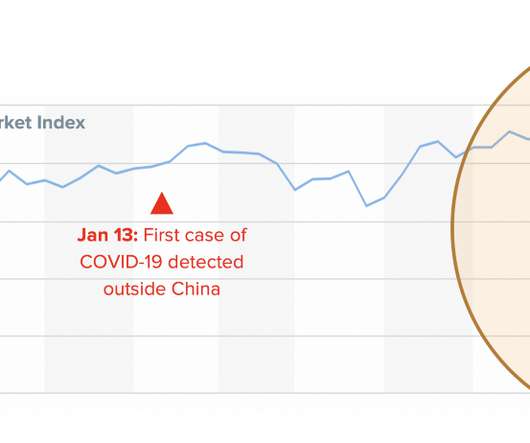

I am due to speak at the SaaStr conference next week: Wednesday, March 11th at 10:45 AM. I had originally signed up to talk about the “VC Market Trends” overall but it seemed inauthentic to speak about VC funding without addressing the virus in the room. I welcome any feedback.

Let's personalize your content