7 Considerations In Choosing A Startup Funding Source

Startup Professionals Musings

MARCH 12, 2023

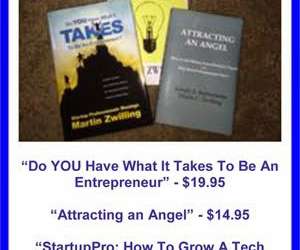

Too many entrepreneurs tell me they are looking for an investor, and can’t differentiate between venture capital (VC) investors versus accredited angel investors. They fail to realize that the considerations are quite different for each, which can make or break their investment efforts, and ultimately their startup.

Let's personalize your content