8 Keys To Maximizing Your New Venture Stock Net Worth

Startup Professionals Musings

SEPTEMBER 27, 2023

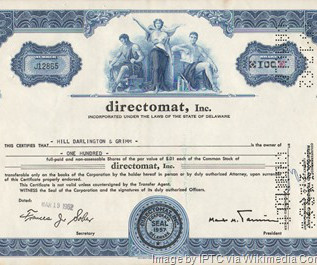

Make sure the government waits for a stock sale to collect taxes. While new equity owners always have to get it from someone, actual re-allocation of existing shares should be based on a formula to maximize the value of your remaining founder shares. At that time the original split makes all the difference. In the U.S.,

Let's personalize your content