8 Keys To Maximizing Your New Venture Stock Net Worth

Startup Professionals Musings

SEPTEMBER 27, 2023

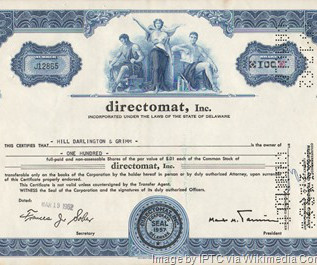

Startup owners need to assume a three to five year wait for a liquidity event, such as acquisition or going public, before they can cash out. The acceptance of this option is now common, even though introduced only a few years ago. At that time the original split makes all the difference. In the U.S.,

Let's personalize your content