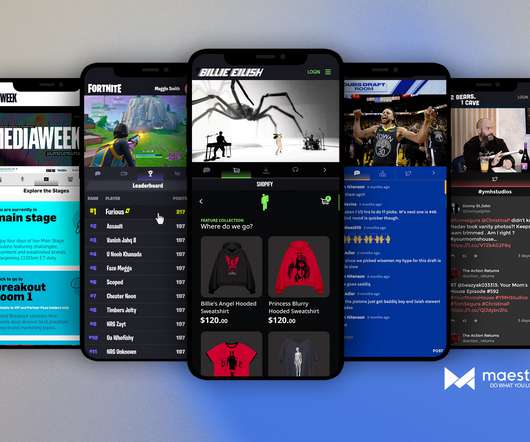

Maestro nets $15 million for its interactive commerce, community and engagement tools for livestreams

TechCrunch LA

MARCH 2, 2021

As video commerce becomes the norm and entertainers, brands, businesses, and franchises of all sizes and stripes look to cut out the middle man, the array of services on offer from Maestro may be the scissors these entities need to cut the cord. The one thing that Maestro won’t do is discovery or search services, Evans said.

Let's personalize your content