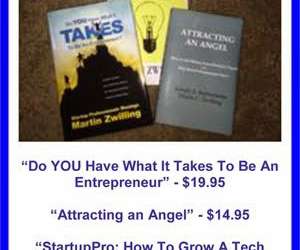

7 Secrets To Bank Equity Funding Without Collateral

Startup Professionals Musings

APRIL 22, 2023

Many entrepreneurs are convinced that banks are not worth the effort for startups, especially early-stage ones that still don’t have a revenue stream, or collateral to back up their financing needs. Provide a simple yet complete description of your product or service and its competitive marketplace. Bankers do not contribute equity.

Let's personalize your content