A heartbreaking story about time and money.

Berkonomics

OCTOBER 5, 2023

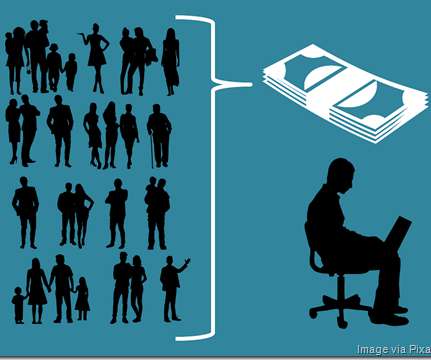

First, think about your time as money! Fixed overhead for salaries, rent, equipment leases and more make up the majority of the “burn rate” (monthly expenses) for most companies. How about young or pre-revenue companies? We often accept that development schedules for young companies are almost always too optimistic.

Let's personalize your content