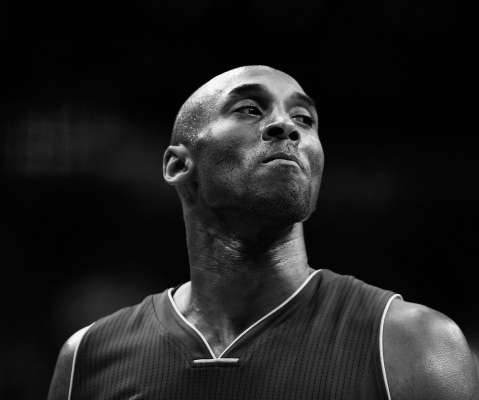

LA tech industry mourns Kobe Bryant

TechCrunch LA

JANUARY 26, 2020

Reports indicate that Bryant, his 13-year-old daughter Gianna Maria-Onore Bryant, and seven other passengers were on board a helicopter traveling to Bryant’s basketball training facility Mamba Academy. Bryant launched his venture career with partner and serial entrepreneur Jeff Stibel back in 2013, according to Crunchbase.

Let's personalize your content