Link-in-bio monetization platform Snipfeed raises a $5.5M seed round

TechCrunch LA

AUGUST 11, 2021

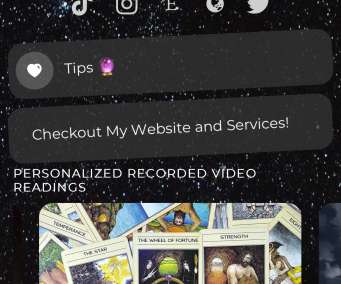

Linktree leads the space, securing a recent $45 million Series B raise to build out e-commerce features, but Beacons boasts competitive creator monetization tools with just a $6 million seed round in May. Now, Snipfeed enters the ring with its own $5.5 We only make money if they make money,” Ramdani said. Image Credits: Snipfeed.

Let's personalize your content